The media is filled with reports that Americans are driving less, and that gasoline demand and oil demand continue to drop. What’s the reality of the situation? Is demand continuing to drop, has it leveled off, or is it rising again? The graphs below tell the story:

Figure 1: US gasoline demand dropped off in 2008. US Gasoline demand is highly cyclical, and figure 2 corrects for this.

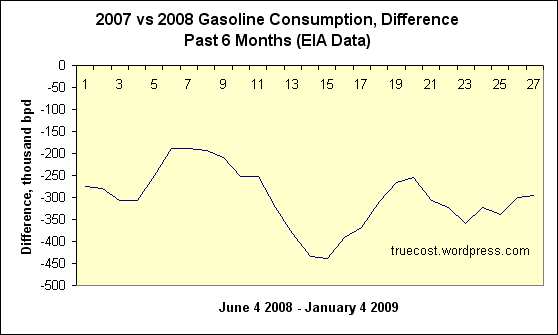

Figure 2: To eliminate seasonality, 2007 demand is subtracted from 2008 demand to measure the difference week by week. This shows that demand crashed in September and October, but has subsequently begun to recover. Low gas prices may be responsible for the demand rebound.

Figure 3: US oil demand also dropped sharply during September and October, but has since recovered to mid-2008 levels. In addition to rising gasoline consumption, residual fuel oil demand is rising since oil is now price-competitive with natural gas.

Figure 4: The long term EIA graph shows that demand growth has leveled off, and that after a sharp drop in late 2008, demand is recovering.

Gasoline and crude oil demand seem to have recovered from the levels experienced during the heart of the financial market meltdown. Intuitively, gasoline demand should rebound a bit, since gasoline price deflation over the past year makes driving a very inexpensive activity for consumers. With the recession curtailing further oil exploration, we may be in for a price shock when economic growth returns!

Note: All data used in the graphs can be found by clicking on the EIA graphs, which link to the appropriate EIA data pages.